|

ECONOMICS |

|

OIL PRICES, impact of their rise

gas price per gallon Nov. 03 $1.50 Gas price per gallon Nov. 04 $2.00 Change in price per gallon $0.50 Average miles per household 25,000 Average miles per gallon 20 Average gallons purchased per year 1,250 Average annual cost from price rise* $656 Discretionary income per US household $2,745 Percentage of discretionary income spent on electronics 30% Total estimate lost electronic sales $21.1 bil Average semiconductor content 20% Total lost semiconductor sales $4.2 bil US share of world market 35% Total potential lost worldwide semiconductor sales $12.1 bil Projected 04 semiconductor sales $214 bil Projected 05 semiconductor sales $214 bil Projected lost sales as percentage of total $5.70% * Includes

estimated cost from higher heating oil prices {missed effect upon utilities}

|

||||||||||||||||||||||||||||||||||

|

Oil, the Energy Crunch??? The economic upturn of 03 should

have continued, for interest rates were low and the December 03 quarter’s growth in GDP was approximately 7%. However, like a balloon the market deflated about 10%, only to regain it former position a month after

Bush’s election, and then come down again. Oil pricked the balloon. Congress had some year before drafted an exception to the fuel economy law, they lumped

SUVs with pickups as excluded and then they gave a massive tax rebate for buying a gas guzzler—as lobbied for by the

oil industry and automotive makers. With 25% or so of the vehicles on the road

getting half the mileage of my Honda, the consumption of oil rose by 3.2% in 04 (and is expected to go up another 1.7%). It would have been going down for years instead of up with the proper incentives. The industry has consistently opposed fuel efficiency incentive. In fact they are currently opposing in the courts California’s new emission regulations of carbon

dioxide. The only way to lower carbon dioxide emission is to lower the amount

of gas used. The current windfall profits for the oil industry is based upon

a steadily rising global consumption as population expands and the fuel efficient of the US drops due to the increasingly

percentage of SUVs and pickup trucks. Current production cannot keep up with

demand as production falls off in field after field due to depletion in reserves. The major avoidable

cause for our slowing economic growth is the higher price of oil. If Congress

only hadn’t extended the fuel efficiency exclusion to SUVs from fuel efficiency standards, our oil consumption would

be down about 10%. Moreover, if pickup truck not registered to a business owner

were also grouped with sedans, then the automakers would have been required to have a more efficient fleet. The legislation passed in 84 raised the standards for vehicles, not per model, but for the entire fleet

marketed by each manufacturer our consumption would have dropped over the last decade at least another 10% from the current

levels. Spending on oil increases our imbalance of trade debt and at the same

time reduces discretionary spending. Thus rather than promoting employment and economic growth, rising

oil prices reduces both and hastens the day when foreign investors in our economy pull out and invest else where, as happened

in Southeast Asia. Spending

on oil reduces employment and wages by reducing the discretionary spending. In

Jan. of 04, presuming the market would keep rising, I invested the funds from the sales of a home into the stock market. The market had risen over 20% in 03, so in February of 04 it underwent a characteristic

adjustment (profit taking), but should have then bounced back. It didn’t

because oil prices started to rise. I thought oil prices would fall again, as

they did in 01. However when they didn’t the market remained at its low

with the typical fluctuation. I had positioned myself for a very positive 04,

and would have over doubled my money. By December 3 04, I was down 20% in my

margin account; what a difference gas-guzzlers made. Thank you Congress and the

last four presidents. We all should be thanking them for our current standard

of living, our current level of real employment, and our status as the world’s largest debtor nation (with one of the

highest rates of debt to GDP). Thank you politicians. Gasoline taxes average 43¢/gal US consumes 25% of the world’s supply, though it is 5% of the population, about 3 gals/person/day. US production is ½ of 1970’s. North Sea, North Slope of Alaska are in decline. Consumption 02 (millions of barrels: US 7,191, Japan

1,935, China 1935, Russia 985, Germany 949 3.2% increase 04, predicted 1.7 for 05 China added 2M cars in 03, up 70% from 02, US consumption 80B barrels, of which 2/3 are for fuel. Business SUV deduction of up to $10,000 In 1981 oil was above

$70/barrel in 2004 dollars, by the mid 80s it dropped to less than $25/barrel. The new deep-water Gulf filed has an estimated 25B barrels, another

almost as large field is in the Artic National Wildlife Refuge in Alaska. Canadian shale oil cover 15,000 sq miles, equals 1.6 trillion barrels,

but yields only 1 barrel for every two of deposit. Gasoline costs $1.57/ gal = .43 tax, .75 crude oil, .24 refining, 15 distribution & marketing. In addition, .80 traffic congestion (time and wasted fuel), pollution (effects upon respiratory health),

.12 leaky oil from refineries & distribution centers. National Geographic,

The End of Cheap Oil, 6/04, p. 97. The most damning charge against the World Bank and the IMF is that

their policies do not bring development as measured by the standard of living of the masses (though it does bring infrastructure,

foreign acquisition, and increasing interest payments). The pyramid of wealth

shifts from an elite few to that of an international corporate elite in conjunction with national politicians and a an ever

dwindling economic elite. Venezuela population of 13,000,000, minimum wage of $153/month, prove

oil reserves of 4,400,000 oil reserve, Southeast Asia Southeast Asia, yet 60% live in abject poverty.

Bush requested a $75,000 SUV tax break in 03, and got a $!00,000 for the least fuel-efficient vehicles. If incentives had continued for oil efficiency, oil would still be under $40/ barrel. This not only means that Americans have less money for trinkets and medical treatments,

but that the poorest nations have less for basic sanitation, medical clinics, and education, and their citizens have less

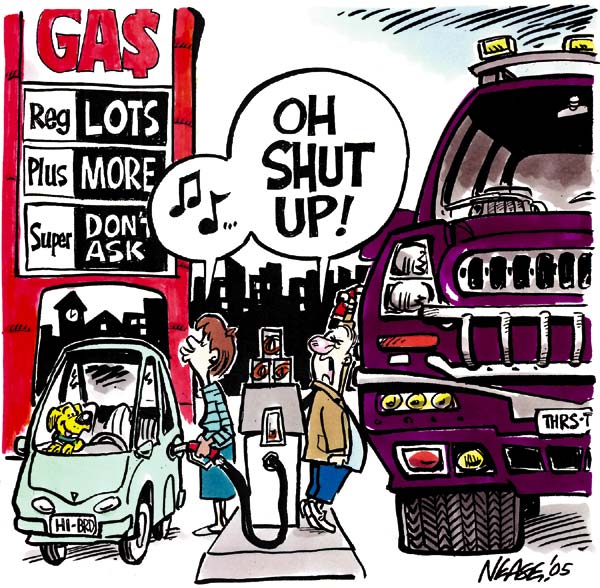

for necessities. Why there are so many pigs on the road:

for the Union of Concerned Scientists’ article on the SUV tax break. For the

best account of the Federal Reserve (http://www.freedocumentaries.org/film.php?id=214). One cannot understand |