|

|

|

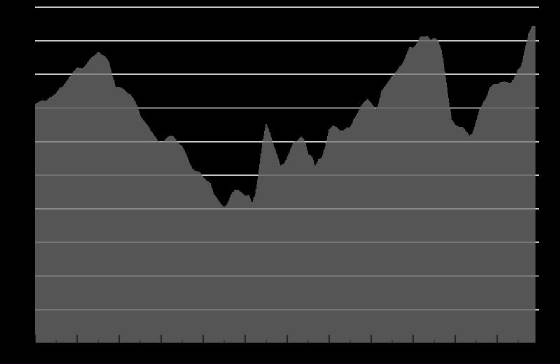

| Industrial production from 1928 to 1940 |

|

| 1928 to 1940 |

The Myth that WWII Ended the Great Depression

The graph shows that the neoliberal account of that period

is flawed (part of their attack on the bottom up Keynesian economics). They hold that the war spending ended the Great Depression

actually ended 6 years earlier. Major US armament buildup didn’t begin

until June of 1941 when the 1940 budget went into effect. To start with the roaring

20’s was not considered a period of depression, thus the economic output long before the peak of 1929 would be a suitable

point as to when the US economic left the depression. I am using January 1928 as a benchmark for prosperity (thus cutting off the 1929 bubble

that began to unravel in May of 1929. Using the Jan. 1928 horizontal line the Great Depression ended in October of 1935. Notice the second crash occurring August of 1937 which rebounded to the Jan. 1928

level in June of 1938. This is well before there were war preparations of 1941. The anti-Keynesian spin is commonly repeated as a fact, even by the critics of neoliberalism.

Under President Hoover March 1929 to March 1933 there was

a tight money policy. For which the epithet “the do-nothing President” was commonly applied. The steady rise under Roosevelt (took office March, 1933). On

March 4th of 1933 began his First Hundred Days (the First New Deal). A variety of Keynesian type programs were instituted to stimulate the economy by producing government jobs and by placing funds into the hands of the masses such as unemployment insurance. During his first term laws were passed regulating banking, Wall Street, and

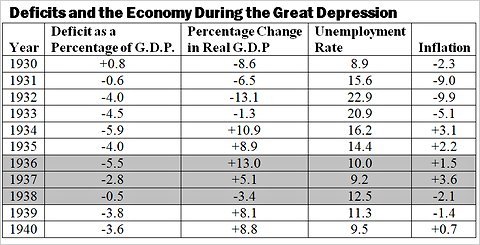

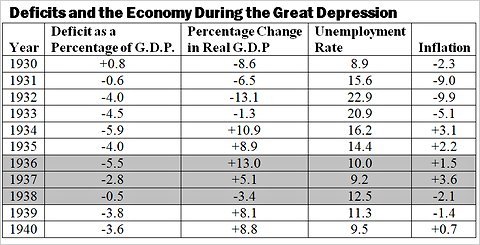

strengthen unions. Social security was passed in 1935. GDP rebounded strongly in 1934, growing 10.9% that year, 8.9% in

1935, 13% in 1936. The second drop in GDP in 1937 had

2 causes, one the reduction in federal budget which ended the work programs and cut other programs. This occurred when Roosevelt yielded to his Treasury Secretary Henry Morgenthau and the pro-business wing

of the Democratic Party, and he abandoned Keynesian economics by cutting several key programs.

The second cause was the Federal Reserve. “Between August 1936 and May 1937 reserve requirements doubled”.

The immediate drop prompted the Democrats to reinstall those programs, and the economy recovered again, and the

Federal Reserve reduced the reserve requirement again. This graph proves the

neoliberal rewrite to be false, which claims Keynesian economics doesn’t work, and that the US didn’t recover

from the depression until massive influx of funds in preparation for WWII. Massive

war production didn’t start until February of 1942, but the economy surpassed January 1928 in December of 1935, and

again in August of 1937, a second confirmation of Keynesian economics that expanding currency/credit and putting funds into

those would will spend it will it is the way to right the economy. (Also false--when

the neoliberals acknowledge the 2nd crash of 1937--is that it was caused by union strikes.) Keynesian economics was widely accepted

based on the results from its application in the US, UK, and elsewhere during the Great Depression. This approach to spending was subsequently widely applied following WWII including in the developed and

under developed countries. The steady growth in median income was attributed

to Keynesian type interventions in the market place. Neoliberals in their rewrite

of economic history attribute current (2007) global decline to the effects of those policies, some of which are still in place. However the stagnation then decline in median income began long before the crisis

of 2007. It began when the Keynesian managed economy was being replaced by supply-side

economics, which started in 1972 under Nixon.

|

|

|

Why Did FDR’s Bank Holiday Succeed?

http://www.newyorkfed.org/research/epr/09v15n1/0907silb.pdf

William L. Silber is the Marcus Nadler Professor of Finance and Economics

at New York University’s Stern School of Busines

• After

a month-long run on banks, on March 5, 1933, President Franklin Delano Roosevelt declared a nationwide Bank Holiday that shut

down the banking system.

• The

following week, in his first Fireside Chat, Roosevelt appealed directly to Americans to prevent a resumption of bank withdrawals;

when the banks reopened on March 13, depositors stood in line to return their hoarded cash.

• The

success of the Bank Holiday and the turnaround in public confidence can be attributed to the Emergency Banking Act of 1933,

passed by Congress on March 9.

• The President used the emergency currency provisions of the Act to encourage the Federal Reserve to create

de facto 100 percent deposit insurance in the reopened banks.

• The

Bank Holiday and the Emergency Banking Act reestablished the integrity of the U.S. payments system and demonstrated the power

of credible regime-shifting policies.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter supporting content here

For the

best account of the Federal Reserve (http://www.freedocumentaries.org/film.php?id=214). One cannot understand U.S. politics, U.S. foreign

policy, or the world-wide economic crisis unless one understands the role of the Federal Reserve Bank and its role in the

financialization phenomena. The same sort of national-banking relationships as

in our country also exists in Japan and most of Europe.

A democracy exists whenever those who are free and poor are in sovereign

control of the government; an oligarchy when the control lies in the hands of the rich and better born.”—Aristotle

“All for ourselves, and nothing for anybody else,” Adam Smith called this the vile maximum of the

masters of mankind. Neoliberals call it, “trickle-down

economics.”

|

In 1963,

John F. Kennedy issued Executive Order 11110 which would have removed the power of money creation from all US private

banks, including the privately-owned Federal Reserve, and invested that power in the US Government. Unfortunately, Kennedy

died suddenly a few weeks later and his plans died with him.

***

The Problems of Debt

In the USA 100% of the money supply is created by the private banks.

In Britain the figure is over 97%. In the rest of the

world, the figure is estimated to be over 95%. All this money is created as a debt. It is created when people borrow money,

as banks do not lend existing money; they just create new money out of thin air to lend.

Money created as a debt by the banks bears a charge of interest. This increases the amount of money that the economy

owes by an amount greater than the amount in existence. This means that the economy is a saddled with a debt that can never

be paid off, merely passed around like a game of Pass-the-Parcel in a Belfast pub. It

is like a game of musical chairs, where someone has to lose out.

***

A Solution

Money does not have to be based on debt, nor indeed does it have to be based on precious metals. Real wealth is the

goods and services that people create for each other. Money is merely a means of exchange. It could be created by HM Treasury

and spent on providing public services, saving us all a modicum of taxation, and then the economy would not have to be saddled

with large debts.

Executive Order 11110 issued by John F. Kennedy on June 4th 1963,

from Wikipedia

This executive order allows the U.S. Secretary of the Treasury to issue $4.29 billion in silver certificates ($2 and $5 Notes) against silver bullion based on authority delegated by the President to the Secretary under the Thomas Amendment

to the Agricultural Adjustment Act.

Silver certificates were printed without

interest. The Order was for the Treasury to issue silver certificates against all silver held by the government which did

not already have certificates against it. The Order was needed due to the passage of Public Law 88-36 which repealed the Silver

Purchase Act and other related monetary measures. One result was that after the repeals, only the President could issue new

silver certificates. The Federal Reserve System could replace the certificates, but only in larger denominations. The thrust of the Order returned the authority to issue new silver certificates (and specify

denominations) back to the U.S. Treasury.

This theory was further explored by U.S.

Marine sniper and veteran police officer Craig Roberts in the 1994 book, Kill Zone.[28] Roberts theorized that the Executive Order was the beginning of a plan by Kennedy whose ultimate goal was to permanently

do away with the United States Federal Reserve, and that Kennedy was murdered by a cabal of international bankers determined

to foil this plan. [jk finds this the most plausible of a dozen theories. Kennedy had expressed extreme frustration of the Bay of Pigs

failure and other issues with the CIA. But

it is hard to believe that the CIA would on its own, for to protect its power structure,

kill the President.]

This executive order allowed for the Federal Reserve System to distribute and exchange

currency at lower denominations that met the growing economic need. The authoritative basis for the Order was substantially

nullified in 1982 with the passage of Public Law 97-258. The Order was never directly reversed, but in 1987, Executive Order

12608 [by Ronald Reagan] revoked the section that added by Executive Order 11110[1], essentially nullifying it.

Kennedy was killed by more than one shooter, and from 2 directions.

See Wikipedia Kennedy assassination conspiracy theories.

1) Former U.S. Marine sniper Craig Roberts and Gunnery Sergeant Carlos Hathcock, who was the senior instructor for the U.S. Marine Corps Sniper Instructor School at

Marine Corps Base Quantico in Quantico, Virginia, both said it could not be done as described by the FBI investigators. “Let

me tell you what we did at Quantico,” Hathcock said. “We reconstructed

the whole thing: the angle, the range, the moving target, the time limit, the obstacles, everything. I don’t know how

many times we tried it, but we couldn’t duplicate what the Warren Commission said Oswald did. Now if I can’t do

it, how in the world could a guy who was a non-qual on the rifle range and later only qualified 'marksman' do it?”[13]

2) Robert McClelland, a physician in the

emergency room who observed the head wound, testified that the back right part of the head was blown out with posterior cerebral tissue and some of the cerebellar tissue was missing. The size of the back head wound, according to his description,

indicated it was an exit wound, and that a second shooter from the front delivered the fatal head shot.[11]

3) Kennedy's death certificate located

the bullet at the third thoracic vertebra — which is too low to have exited his throat.[14] Moreover, the bullet was traveling downward, since the shooter was by a sixth floor window. The autopsy cover sheet

had a diagram of a body showing this same low placement at the third thoracic vertebra. The hole in back of Kennedy's shirt

and jacket are also claimed to support a wound too low to be consistent with the Single Bullet Theory.[15][16]

These three facts are sufficient to prove that the Warren commission was a high-level cover-up

Books

Articles

Teddy Roosevelt's advice that, "We must drive the special interests out of politics.

The citizens of the United States must effectively control the mighty commercial forces which they have themselves called

into being. There can be no effective control of corporations while their political activity remains."

|  |

|

|